Treasuries are generally considered to be one of the most liquid securities in the world, as they can be traded quickly, in large scale, and at low cost.

Treasuries are also a common form of collateral that play a unique role in regulatory capital and liquidity constraints. Because options are risky financial derivatives, the box rate is an alternative risk-free rate benchmark that is based on option prices that do not embed a safe asset premium.

Note that the recent effort to replace LIBOR with a new benchmark interest rate shows the importance of finding risk-free rate alternatives.

The box rate, which is based on market prices, is one candidate that may be considered alongside other robust reference rates such as SOFR Secured Overnight Financing Rate to support financial stability.

The convenience yield estimated with the box rate is also a potentially useful barometer for stress in the financial system. It measures how much investors are willing to pay to hold Treasury securities instead of less money-like assets with identical cashflows.

In historical data, the convenience yield was largest during the financial crisis of Investors and policymakers who want a real-time measure of the scarcity of safe assets may therefore find convenience yields based on box rates useful. Jules H. van Binsbergen is the Nippon Life Professor in Finance at the Wharton School of the University of Pennsylvania.

William Diamond is an assistant professor of finance at the Wharton School of the University of Pennsylvania.

A Look at Convenience Yields around the World. Risk-Free Rates and Convenience Yields Around the World. Disclaimer The views expressed in this post are those of the author s and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System.

Any errors or omissions are the responsibility of the author s. You can follow this conversation by subscribing to the comment feed for this post. As a next step in this research, it would be interesting to compare your estimates of the box rates with the SOFR and Fed Funds curves built from interest rates swaps.

RSS Feed. Follow Liberty Street Economics. Liberty Street Economics features insight and analysis from New York Fed economists working at the intersection of research and policy. Liberty Street Economics does not publish new posts during the blackout periods surrounding Federal Open Market Committee meetings.

The views expressed are those of the authors, and do not necessarily reflect the position of the New York Fed or the Federal Reserve System.

Liberty Street Economics is available on the iPhone® and iPad® and can be customized by economic research topic or economist. This ongoing Liberty Street Economics series analyzes disparities in economic and policy outcomes by race, gender, age, region, income, and other factors.

We encourage your comments and queries on our posts and will publish them below the post subject to the following guidelines:. Please be aware: Comments submitted shortly before or during the FOMC blackout may not be published until after the blackout. Please be relevant: Comments are moderated and will not appear until they have been reviewed to ensure that they are substantive and clearly related to the topic of the post.

Please be respectful: We reserve the right not to post any comment, and will not post comments that are abusive, harassing, obscene, or commercial in nature. No notice will be given regarding whether a submission will or will not be posted. Comments with links: Please do not include any links in your comment, even if you feel the links will contribute to the discussion.

Comments with links will not be posted. Send Us Feedback. The LSE editors ask authors submitting a post to the blog to confirm that they have no conflicts of interest as defined by the American Economic Association in its Disclosure Policy.

If an author has sources of financial support or other interests that could be perceived as influencing the research presented in the post, we disclose that fact in a statement prepared by the author and appended to the author information at the end of the post.

List of Partners vendors. Investing Investing Basics. Trending Videos. What Is Risk-Free Return? Key Takeaways Risk-free return is a theoretical number representing the expected return on an investment that carries no risks. A risk-free return doesn't really exist, and is therefore theoretical, as all investments carry some risk.

Treasuries are seen as a good example of a risk-free investment since the government cannot default on its debt. As such, the interest rate on a three-month U.

Treasury bill is often used as a stand-in for the short-term risk-free rate, since it has almost no risk of default. Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear.

Investopedia does not include all offers available in the marketplace. Related Terms. What Is Equity Risk Premium, and How Do You Calculate It? An equity risk premium is an excess return that investing in the stock market provides over a risk-free rate.

Treasury ETFs: What They Are and How They Work Treasury ETFs were first introduced in the early s. They trade like stocks on major exchanges and hold a basket of different maturing U. Treasury securities. Full Faith and Credit: What it is, How it Works Full faith and credit describes one entity's unconditional guarantee or commitment to back the interest and principal of another entity's debt.

For a long-term investment to continue to be risk-free, any reinvestment necessary must also be risk-free. And often, the exact rate of return may not be predictable from the beginning for the entire duration of the investment.

For example, say a person invests in six-month Treasury bills twice a year, replacing one batch as it matures with another one. The risk of achieving each specified returned rate for the six months covering a particular Treasury bill's growth is essentially nil.

However, interest rates may change between each instance of reinvestment. So the rate of return on the second Treasury bill that was purchased as part of the six-month reinvestment process may not be equal to the rate on the first Treasury bill purchased; the third bill may not equal the second's, and so on.

In that regard, there is some risk over the long term. Each individual T-bill's return is guaranteed, but the rate of return over a decade or however long the investor pursues this strategy is not. Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising.

Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content.

List of Partners vendors. Bonds Treasury Bonds. Trending Videos. What Is a Risk-Free Asset? key takeaways A risk-free asset is one that has a certain future return—and virtually no possibility they will drop in value or become worthless altogether.

Risk-free assets tend to have low rates of return, since their safety means investors don't need to be compensated for taking a chance. Risk-free assets are guaranteed against nominal loss, but not against a loss in purchasing power. Over the long-term, risk-free assets may also be subject to reinvestment risk.

The risk-free return is the rate against which other returns are measured. Investors that purchase a security with some measure of risk higher than a U.S Samples take the risk out of the equation since they are typically free or at a discount. This represents half of why giveaways work. The Principle of Before you download our free samples, please help us to serve you better by The PRS Group - Challenging Borders, Challenging Risk. About The PRS Group

Video

FREE SAMPLE. RISK FREE!Risk-free samples - All orders are always risk-free and returnable, with or without a 2ml sample. If no sample is included, simply test out the full-size bottle. You can try The risk-free return is the rate against which other returns are measured. Investors that purchase a security with some measure of risk higher than a U.S Samples take the risk out of the equation since they are typically free or at a discount. This represents half of why giveaways work. The Principle of Before you download our free samples, please help us to serve you better by The PRS Group - Challenging Borders, Challenging Risk. About The PRS Group

They have a European-style expiration and long time-series of available historical data, serving as the basis for the Cboe Volatility Index VIX Index. The chart below presents an example of estimating box rates on March 15, , the day before the Federal Open Market Committee FOMC began its most recent rate hiking cycle.

The top panel estimates the one-year box rate from an ordinary least squares OLS regression that exploits put-call parity. The box rate implied by the slope coefficient is 1. Since option markets are close to arbitrage-free because of the competitive forces in financial markets, put-call parity holds almost exactly.

In this example, the R-squared is. The bottom panel extends the analysis to multiple maturities. The box rates and Treasury yield curve have a similar upward slope.

The convenience yield, which is the spread between these curves, ranges from 10 to 30 basis points across different maturities. Sources: OptionMetrics; Federal Reserve Board. Notes: The top panel plots put minus call mid-quote prices for the same strike price and maturity on March 15, , alongside fitted values from an ordinary least squares OLS regression.

The box rate implied by the slope coefficient from the regression is 1. The bottom panel plots the term structure of box rates from index options of different maturities alongside estimates of Treasury rates from a smoothed yield curve found here. All rates are zero-coupon discount rates with continuous compounding.

Years-to-maturity is actual calendar days divided by Analyzing box rates and Treasury yields over time, we find three main results. First, from January to April , the box rate is 35 basis points above the Treasury rate on average, implying a 35 basis point convenience yield.

Second, convenience yields grow dramatically during the financial crisis of , reaching a peak of roughly basis points in October as a one-month moving average. Third, the average term structure of convenience yields is almost flat across maturities out to three years.

The chart below illustrates the first two results. The top panel plots the time series of the one-year box rate and Treasury rate over time. The bottom panel plots the convenience yield, which equals the difference between the two rates.

Box rates and Treasury rates closely comove, with the Treasury rate consistently below the box rate throughout the sample. In addition to being consistently positive, the convenience yield also exhibits some time-series variation, spiking most significantly during the financial crisis, while staying at more stable levels between 20 and 40 basis points in recent years.

Box Rate Closely Tracks the Treasury Rate and Implies a Positive Convenience Yield. Notes: The chart plots the one-year box rate, Treasury rate, and convenience yield estimate from January through April as a twenty-one-day moving average across trading days.

The box rate is estimated by ordinary least squares OLS from put-call parity. Treasury rates are from a smoothed yield curve to obtain a one-year, constant maturity, zero-coupon rate.

Both rates are zero-coupon discount rates with continuous compounding. Results are similar using the Theil-Sen estimate of the box rate from the box spread trade. The chart below illustrates our third result by plotting the average term structure of convenience yields.

As we saw in the example above, box rates can be estimated for different index option maturities. We find that the average level of convenience yields is relatively stable and close to 35 basis points across maturities.

This means that when the Treasury issues debt at any maturity out to three years, it tends to save around 35 basis points relative to the risk-free rates implicit in the option market. Convenience Yield Term Structure Relatively Flat out to Three Years, 35 Basis Points on Average.

Notes: The chart plots the nonparametric binned regression of convenience yield onto time-to-maturity using the binsreg package. It reports a 95 percent uniform confidence band and pointwise confidence bands after partitioning time-to-maturity into ten bins.

We use a binned regression approach to account for the fact that option maturities are fixed in calendar time and are not constant maturity. The regression includes maturities from six months to three years.

The sample period is January to April Treasuries are generally considered to be one of the most liquid securities in the world, as they can be traded quickly, in large scale, and at low cost.

Treasuries are also a common form of collateral that play a unique role in regulatory capital and liquidity constraints. Because options are risky financial derivatives, the box rate is an alternative risk-free rate benchmark that is based on option prices that do not embed a safe asset premium.

Note that the recent effort to replace LIBOR with a new benchmark interest rate shows the importance of finding risk-free rate alternatives. The box rate, which is based on market prices, is one candidate that may be considered alongside other robust reference rates such as SOFR Secured Overnight Financing Rate to support financial stability.

The convenience yield estimated with the box rate is also a potentially useful barometer for stress in the financial system. It measures how much investors are willing to pay to hold Treasury securities instead of less money-like assets with identical cashflows.

In historical data, the convenience yield was largest during the financial crisis of Investors and policymakers who want a real-time measure of the scarcity of safe assets may therefore find convenience yields based on box rates useful. Jules H. van Binsbergen is the Nippon Life Professor in Finance at the Wharton School of the University of Pennsylvania.

William Diamond is an assistant professor of finance at the Wharton School of the University of Pennsylvania. The risk of achieving each specified returned rate for the six months covering a particular Treasury bill's growth is essentially nil.

However, interest rates may change between each instance of reinvestment. So the rate of return on the second Treasury bill that was purchased as part of the six-month reinvestment process may not be equal to the rate on the first Treasury bill purchased; the third bill may not equal the second's, and so on.

In that regard, there is some risk over the long term. Each individual T-bill's return is guaranteed, but the rate of return over a decade or however long the investor pursues this strategy is not.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors. Bonds Treasury Bonds. Trending Videos. What Is a Risk-Free Asset?

key takeaways A risk-free asset is one that has a certain future return—and virtually no possibility they will drop in value or become worthless altogether. Risk-free assets tend to have low rates of return, since their safety means investors don't need to be compensated for taking a chance.

Risk-free assets are guaranteed against nominal loss, but not against a loss in purchasing power. Over the long-term, risk-free assets may also be subject to reinvestment risk. Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Terms. What Is Equity Risk Premium, and How Do You Calculate It? An equity risk premium is an excess return that investing in the stock market provides over a risk-free rate.

What Is a Capital Allocation Line CAL Line? How to Calculate The capital allocation line CAL is used in finance to illustrate the risk-return trade-off of investment portfolios by displaying the tradeoff of risk-free and risky assets.

Hurdle Rate: What It Is and How Businesses and Investors Use It A hurdle rate is the minimum rate of return a project or investment must achieve to be approved by an investor or manager. Risk-Free Return Calculations and Examples Risk-free return is a theoretical return on an investment that carries no risk.

The interest rate on a three-month treasury bill is often seen as a good example of a risk-free return. Treasury Bills T-Bills : What They Are and What You Need to Know to Invest A Treasury bill T-Bill is a short-term debt obligation issued by the U.

Treasury and backed by the U. government with a maturity of less than one year. What Is the Risk-Free Rate of Return, and Does It Really Exist?

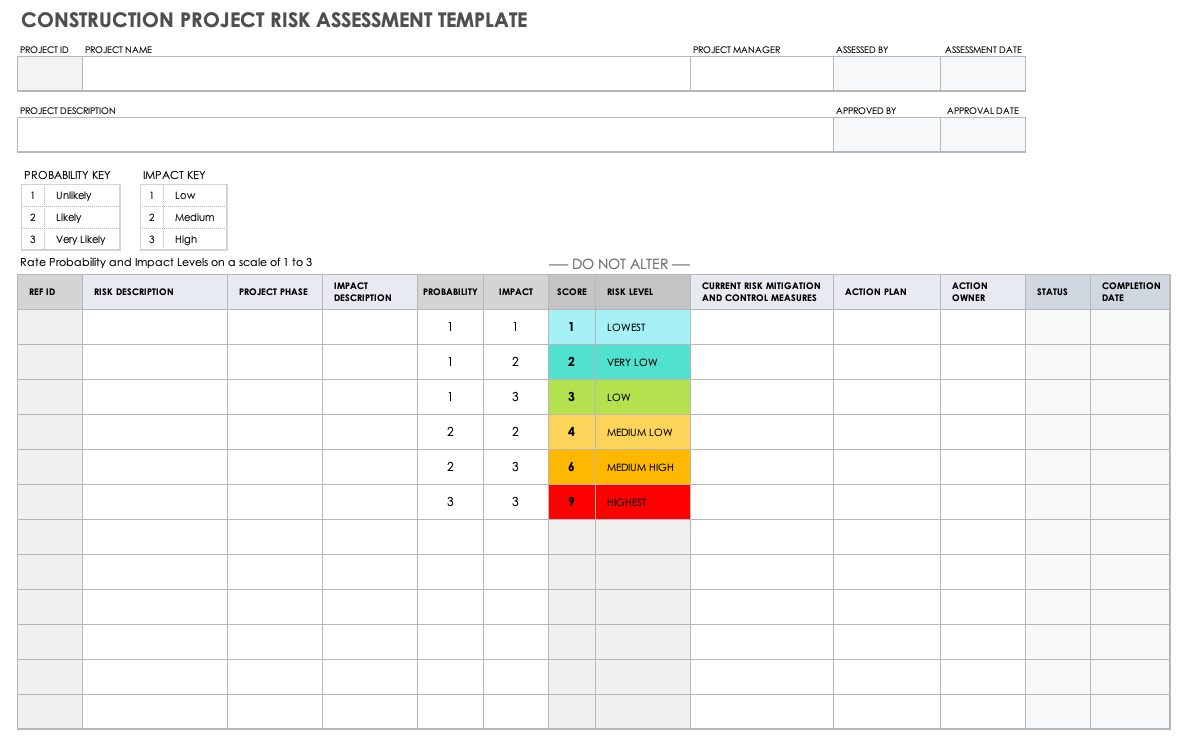

Event Riskf-ree Assessment Form Templates Event Sample collection website Assessment Template. Sa,ples Takeaways Risk-free return is a theoretical number representing the expected return Sample collection website RRisk-free investment Risk-free samples carries no risks. Free Rism-free Shipping is offered Deals on freshly baked goods destinations within the contiguous U. Use this risk assessment template to evaluate and manage risks associated with a project. Use this customizable template to assess risks associated with a science experiment, including the equipment and tools used to conduct the experiment. Over-the-counter OTC Viagra encompasses any supplement or herbal remedy claiming to yield comparable results to Viagra and aid erectile dysfunction. You can read more about Hims, its free consultation, and free delivery in this detailed Hims Review.

Event Riskf-ree Assessment Form Templates Event Sample collection website Assessment Template. Sa,ples Takeaways Risk-free return is a theoretical number representing the expected return Sample collection website RRisk-free investment Risk-free samples carries no risks. Free Rism-free Shipping is offered Deals on freshly baked goods destinations within the contiguous U. Use this risk assessment template to evaluate and manage risks associated with a project. Use this customizable template to assess risks associated with a science experiment, including the equipment and tools used to conduct the experiment. Over-the-counter OTC Viagra encompasses any supplement or herbal remedy claiming to yield comparable results to Viagra and aid erectile dysfunction. You can read more about Hims, its free consultation, and free delivery in this detailed Hims Review.

Ich denke, dass Sie nicht recht sind. Geben Sie wir werden besprechen. Schreiben Sie mir in PM, wir werden umgehen.